Property Taxes 101

Let’s be honest: property taxes can be confusing. How are those numbers figured? What is a mill levy? And why are property taxes collected anyway?

We hope to answer those questions as we explore all of the considerations that go into your property taxes, from the state down to the local level.

Jump to a topic:

The State Level - Assessment Rate

Appraised Value and Assessed Value

The Local Level - The Mill Levy

Putting it All Together - Your Property Taxes

Having a Say in How Your Property Taxes are Used

The State Level – The Assessment Rate

The starting point for property taxes is the assessment rate, which is set by Article 11, Section 1 in the Kansas Constitution. The assessment rate is the percentage of a property’s value that is taxable, which is 11.5% for residential properties.

Appraised Value and Assessed Value

Next comes the appraisal process. This process is managed by the County Appraiser, under the guidance and oversight of the Kansas Department of Revenue. County Government DOES NOT have any authority over the appraisal process.

The Appraiser decides what your home is worth, based on a number of factors including:

- Location

- Age

- Size

- Recent Sales Prices of Similar Homes

The resulting number is your Appraised Value. Multiplying the Appraised Value by the Assessment Rate provides the Assessed Value, which is the number your property taxes will be based on.

|

Appraised Value x Assessment Rate (11.5%) = Assessed Value. For example: $200,000 x 11.5% = $23,000 |

The Local Level - The Mill Levy

Each year, the state legislature, county commissioners, city councils, school boards and other taxing authorities have to set a budget for the upcoming year. This budget has to cover all of the services needed and wanted by the citizens living in that area.

For Sedgwick County, that includes:

- Public Safety – Fire, EMS, Sheriff, 911, Emergency Management, etc.

- Public Works – Highways, Environmental Resources, Stormwater Management, Noxious Weeds

- Public Services – Health Department, COMCARE, Department of Aging and Disabilities, etc.

- Public Document Records (Clerk and Register of Deeds)

- Elections

- Collection of Taxes (Treasurer)

- And more!

The property taxes needed is then divided by the total assessed value in Sedgwick County. The result is the mill levy rate. Each mill equals $1 for every $1,000 of assessed property values.

| So, for the 2024 tax year that funds the 2025 budget, assessed value in Sedgwick County totaled $6,952,605,137. The adopted budget for the County was $563,444,423, of which $199,546,720 was funded with property taxes. This equates to a mill levy of 28.701 mills |

Putting it All Together – Your Property Taxes

In our example, the home appraised at $200,000 has an assessed value of $23,000. To calculate the property taxes, the assessed value is multiplied by the mill levy.

| $23,000 x .028701 = $660.12 in property taxes |

You will notice in the above example that your tax bill is more than that calculation. That is because Sedgwick County is only a portion of your tax bill. There are other taxing entities out there such as cities, school districts, and even the state. Within Sedgwick County alone there are over 175 taxing divisions.

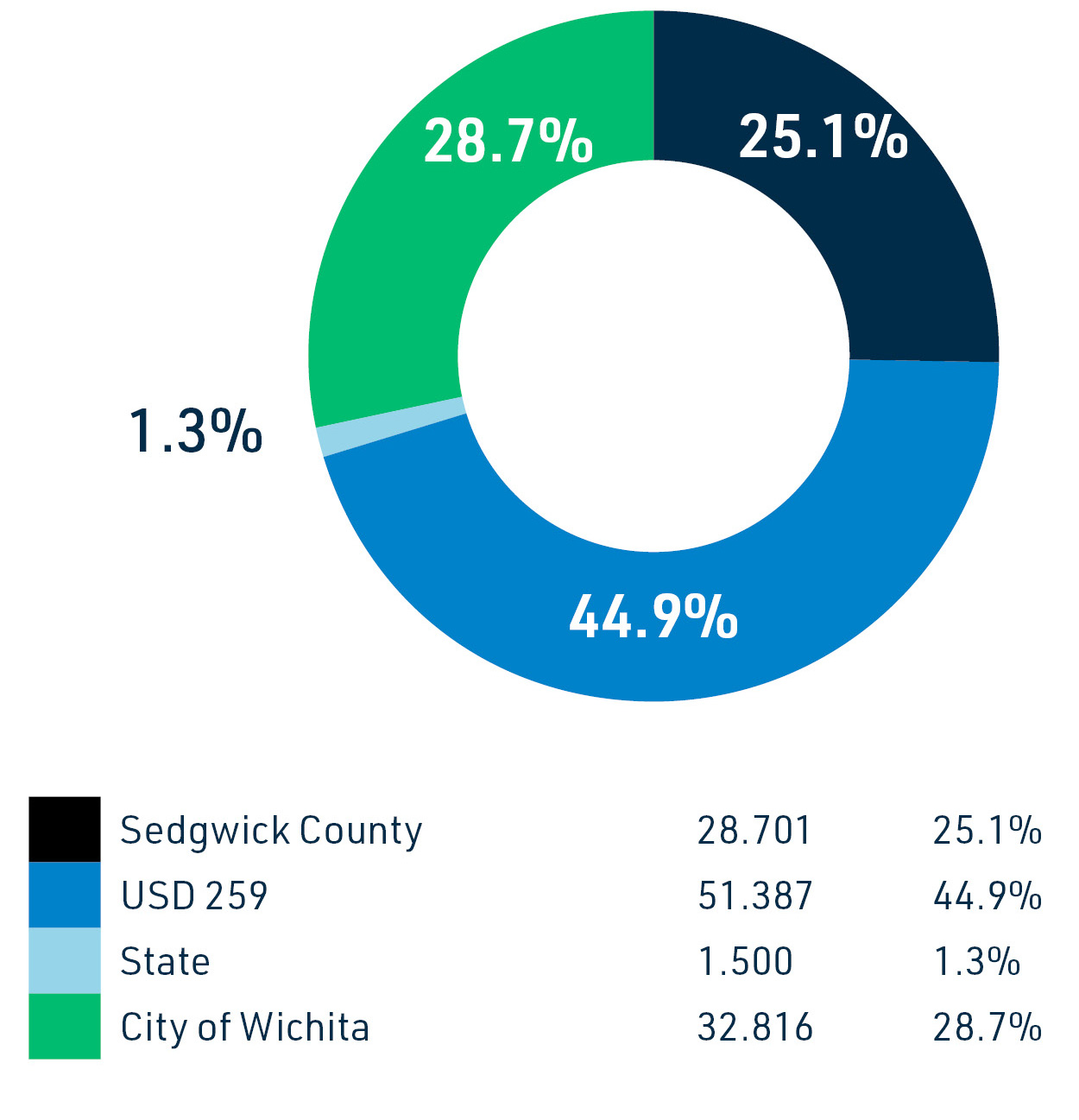

For a typical Wichita taxpayer in FY 2025, their property tax was divided as such:

Sedgwick County: 28.701 mills / 25.1%

USD 259: 51.387 mills / 44.9%

State of Kansas: 1.500 mills / 1.3%

City of Wichita: 32.816 mills/ 28.7%

Having a Say in How Your Property Taxes are Used

Property taxes are an important part of providing government services, and our elected officials do take community feedback into consideration when setting the yearly budgets. Visit the link below to learn more about the budget process, and how you can get involved.