Tax Increment Finance (TIF) Districts

Tax Increment Finance Districts

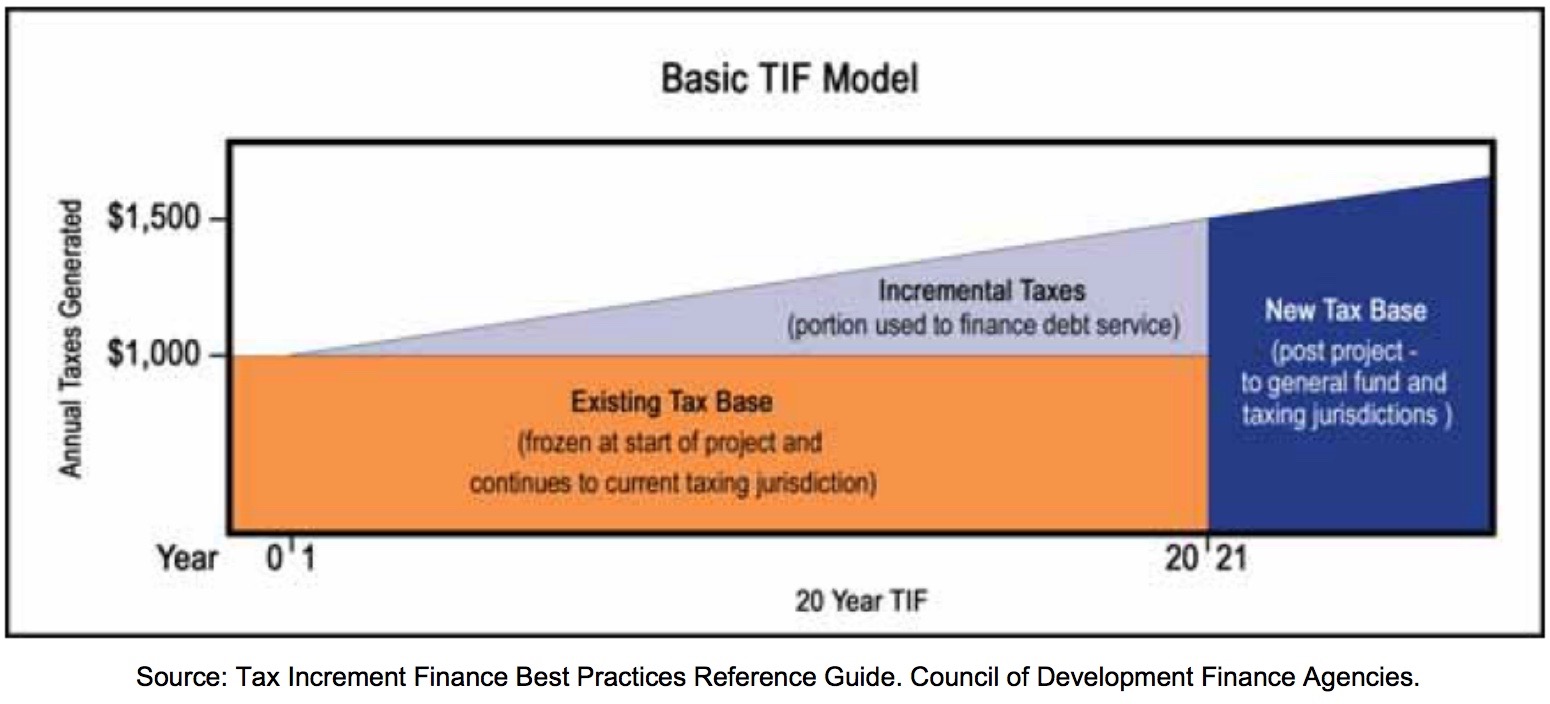

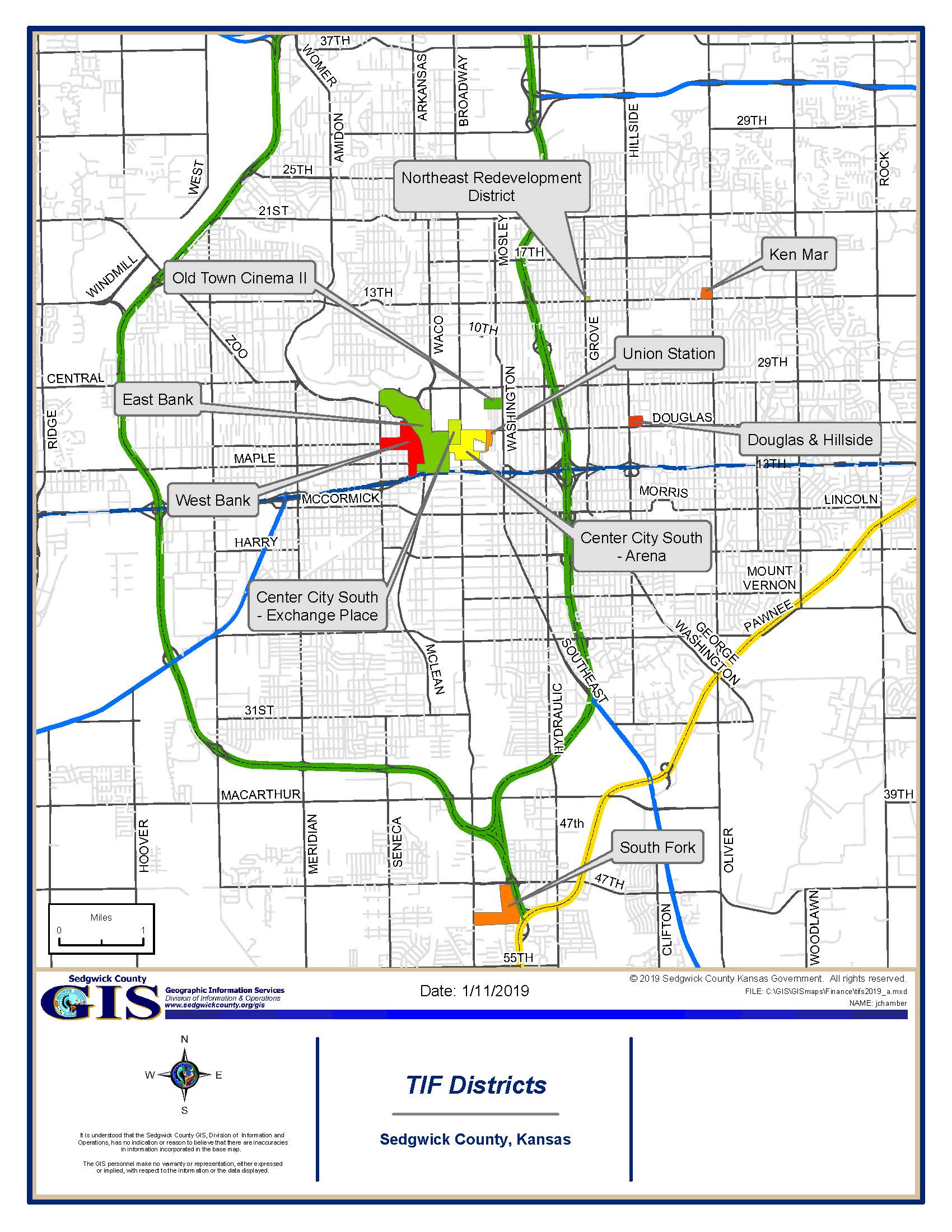

Since 1993, Sedgwick County has participated with the City of Wichita in the funding of Tax Increment and Tax Decrement Districts. TIF Districts are designed as community and economic development tools to pay for current infrastructure improvements with future tax revenues. They work by capturing tax revenues from increased valuations for a defined period of time and using those revenues to pay for the improvements. Tax revenues for the participating governments remain basically flat during this time period.

There are currently 9 active TIFs in Sedgwick County as shown on the map below:

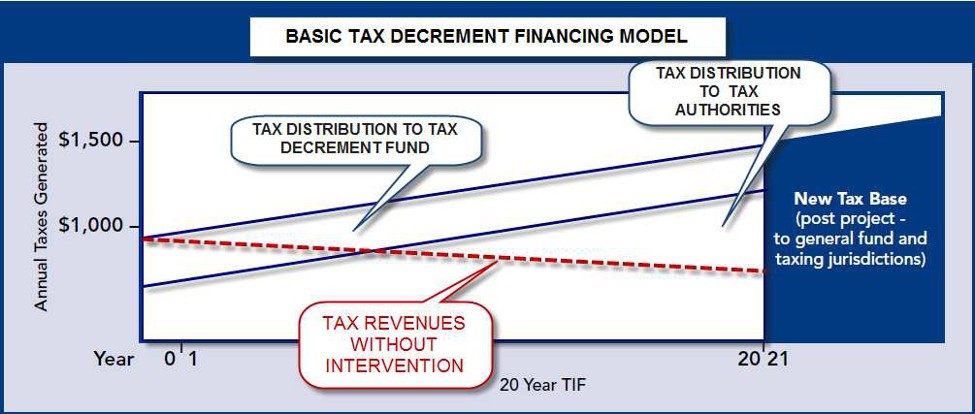

Tax Decrement Finance Districts

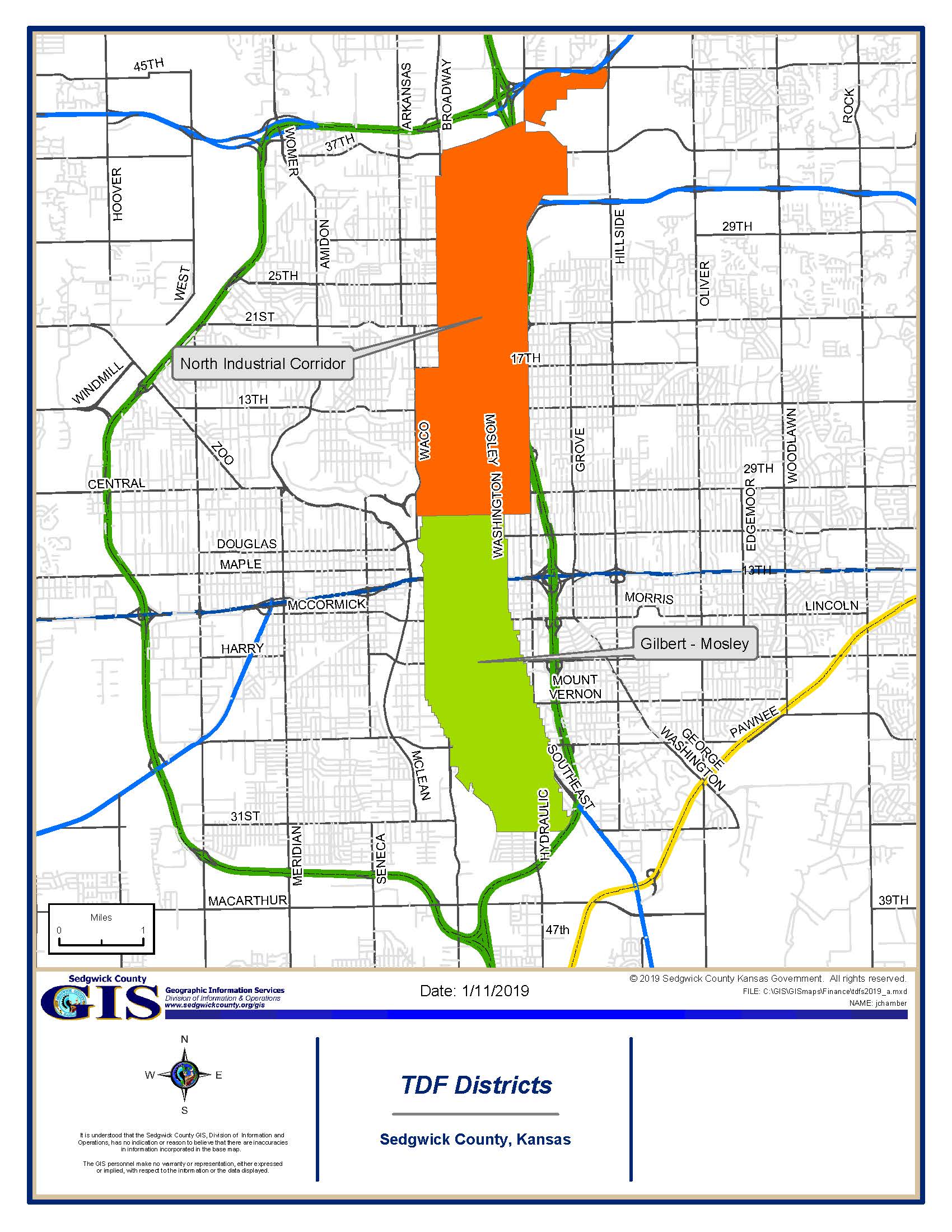

Tax Decrement Districts have been used to reverse trends of declining property values due to groundwater contamination within certain geographic areas. The TDFs provide a mechanism to apply a percentage of the tax revenues generated within the area directly to environmental remediation efforts prior to being distributed to the participating tax districts, ensuring a clean, sustainable water supply for future generations.

There are currently 2 active TDFs in Sedgwick County as shown on the map below: